Unemployment Insurance Resources and FAQs for Employees

Eligibility

Am I eligible for unemployment insurance? The U.S. Department of Labor's unemployment insurance programs provide unemployment benefits to eligible workers who become unemployed through no fault of their own and meet certain other eligibility requirements.

Each state sets its own unemployment insurance benefits eligibility guidelines, but you usually qualify if you:

- Are unemployed through no fault of your own. In most states, this means you have to have separated from your last job due to a lack of available work.

- Meet work and wage requirements. You must meet your state’s requirements for wages earned or time worked during an established period of time referred to as a "base period." (In most states, this is usually the first four out of the last five completed calendar quarters before the time that your claim is filed.)

- Meet any additional state requirements.

- The federal government is also allowing new options for states to amend their laws to provide unemployment insurance benefits related to COVID-19.

For example, federal law allows states to pay benefits where:

- An employer temporarily ceases operations due to COVID-19, preventing employees from coming to work;

- An individual is quarantined with the expectation of returning to work after the quarantine is over; and

- An individual leaves employment due to a risk of exposure or infection or to care for a family member.

- Filing a Claim

Where do I file a claim? Please check the state link to find details on their unemployment insurance program and to see where to file. Most agencies are currently only accepting claims online or by appointment. Please do not go to the unemployment office without checking to see if they will accept walk-ins.

State Link to UI claim filing

Alaska https://labor.alaska.gov/unemployment/

Alabama https://labor.alabama.gov/unemployment.aspx

Arkansas https://www.dws.arkansas.gov/unemployment/

Arizona https://des.az.gov/services/employment/unemployment-individual

California https://www.edd.ca.gov/Unemployment/File_an_Unemployment_Insurance_Claim.htm

Colorado https://www.colorado.gov/pacific/cdle/unemployment

Connecticut http://www.ctdol.state.ct.us/UI-online/index.htm

District of Columbia https://does.dc.gov/service/start-your-unemployment-compensation-process

Delaware https://ui.delawareworks.com/

Florida https://www.stateofflorida.com/articles/florida-unemployment/

Georgia https://dol.georgia.gov/online-services

Hawaii https://huiclaims.hawaii.gov/

Iowa https://www.iowaworkforcedevelopment.gov/file-claim-unemployment-insurance-benefits

Idaho https://www.labor.idaho.gov/dnn/Unemployment-Benefits

Illinois https://www2.illinois.gov/ides/Pages/default.aspx

Indiana https://www.in.gov/dwd/2362.htm

Kansas https://www.getkansasbenefits.gov/Home.aspx

Kentucky http://www.kewes.ky.gov/

Louisiana http://www.laworks.net/UnemploymentInsurance/UI_Claimants.asp

Massachusetts https://www.mass.gov/applying-for-unemployment-benefits

Maryland https://www.dllr.state.md.us/employment/unemployment.shtml

Maine https://www.maine.gov/unemployment/

Michigan https://www.michigan.gov/leo/0,5863,7-336-78421_97241---,00.html

Minnesota https://www.uimn.org/

Missouri https://labor.mo.gov/unemployed-workers

Mississippi https://mdes.ms.gov/unemployment-claims/

Montana http://uid.dli.mt.gov/

North Carolina https://des.nc.gov/apply-unemployment

North Dakota https://www.jobsnd.com/

Nebraska https://www.dol.nebraska.gov/UIBenefits

New Hampshire https://www.nhes.nh.gov/services/claimants/file.htm

New Jersey https://myunemployment.nj.gov/

New Mexico https://www.dws.state.nm.us/en-us/Unemployment

Nevada http://ui.nv.gov/css.html

New York https://labor.ny.gov/unemploymentassistance.shtm

Ohio https://unemployment.ohio.gov/

Oklahoma unemployment.ok.gov

Oregon https://www.oregon.gov/employ/unemployment/pages/default.aspx

Pennsylvania https://www.uc.pa.gov/Pages/default.aspx

Rhode Island http://www.dlt.ri.gov/ui/

South Carolina https://dew.sc.gov/individuals/apply-for-benefits

South Dakota https://dlr.sd.gov/ra/individuals/default.aspx

Tennessee https://www.tn.gov/workforce/unemployment.html

Texas https://twc.texas.gov/jobseekers/unemployment-benefits-services

Utah https://jobs.utah.gov/ui/home/initialclaims

Virginia http://www.vec.virginia.gov/unemployed

Virgin Islands https://www.vidol.gov/

Vermont https://labor.vermont.gov/unemployment-insurance

Washington https://esd.wa.gov/unemployment

Wisconsin https://dwd.wisconsin.gov/uiben/

West Virginia https://workforcewv.org/unemployment

Wyoming http://wyomingworkforce.org/workers/ui/

Puerto Rico https://desempleo.trabajo.pr.gov/reclamacionsubsiguiente/

If I worked in multiple states, where should I file for unemployment insurance? Unemployment insurance is a joint state-federal program that provides cash benefits to eligible workers. All states follow the same guidelines established by federal law, but each state administers a separate unemployment insurance program and has different qualification rules. Please check with your residency state first. If you do not qualify with your residency state, then check with the state you performed most of your work in.

If I worked for multiple companies, can I file multiple claims? Typically, you would file one claim and list all of your employers of record for a certain time period. For any jobs you worked on that GreenSlate processed the payroll for, you will be able to find your employer of record information on your latest paystub. For further help, please contact the state agency you are filing with.

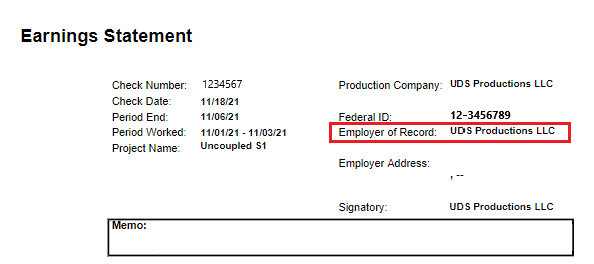

Who is my employer? For any jobs you worked on that GreenSlate processed the payroll for, your employing company's name is listed on your last paystub in the upper right hand corner under “Employer of Record.”

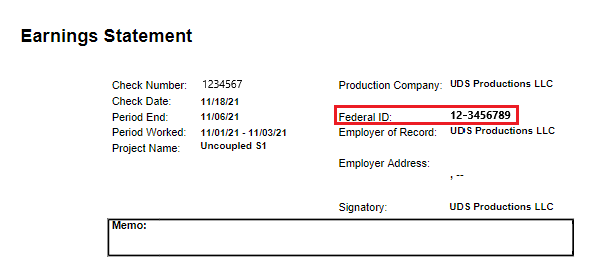

What is my employer's FEIN? For any jobs you worked on that GreenSlate processed the payroll for, your employer's FEIN is listed right above the Employer of Record name.

The claim form requires an address for the employer. What should I use? For any jobs you worked on that GreenSlate processed the payroll for, please use 61 Main St, Flr 2, Delhi, NY 13753. This will ensure the claim is sent to GreenSlate and alleviates any delay by the claim going to a different address.

The claim form requires a contact phone number. What should I put? For any jobs you worked on that GreenSlate processed the payroll for, please use 212-206-1099.

Have additional questions? If you have additional questions, your first resource should be the state agency you are filing your claim with. If you need additional information to complete your claim and GreenSlate processed the payroll for the last job you were on, you can send an email to operations@gslate.com. Please include your name and last four digits of your SSN in your request so we can facilitate your email as quickly as possible.