Managing Holiday Accrual Payments & Accounts

- Be sure to add holiday accrual accounts to your chart of accounts. These accounts are commonly added to the payroll clearing accounts category, but they can be added to other liability categories. If you need assistance adding an account, please refer to our article on How to: Add/Edit/Delete/Deactivate an Account

Note: If your chart of accounts already contains your holiday accrual account, you may disregard this step.

- Set employee default accrual codes. If you'd like GreenSlate to update employee default accrual codes, you may communicate to your Paymaster the needed updates. For digital start work employees, we have a guide to set employee default codes when prefilling start work, or update employee default codes for existing employees.

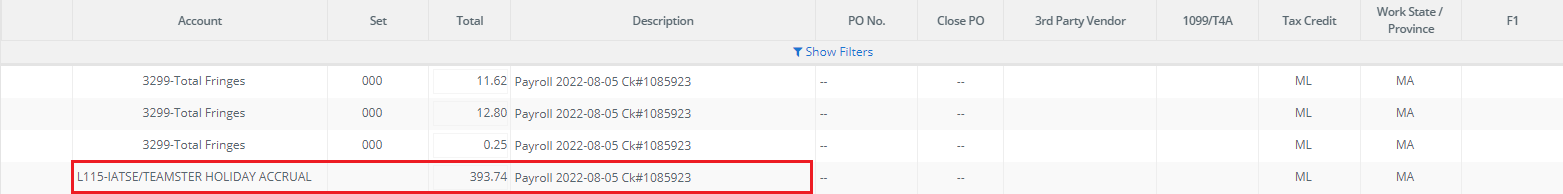

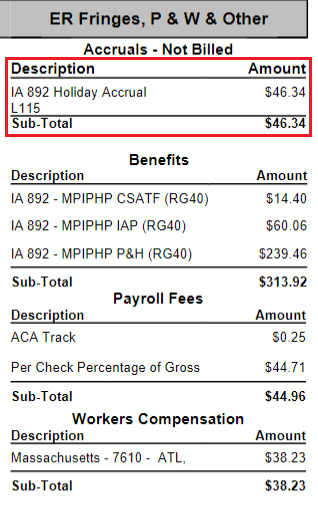

- When payroll for regular work is processed, employees with holiday accrual fringes will accrue holiday pay. You can see the amount of the accrual on your payroll edit. When payroll is posted, the payroll transactions will show a debit (+) to the fringe account for the employee and a credit (-) to the accrual account for the amount seen on the edit.

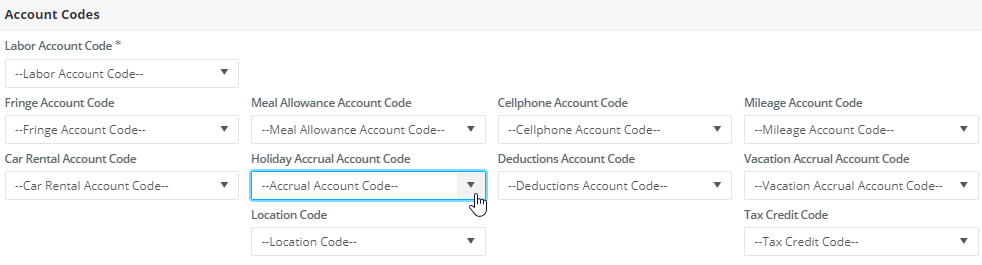

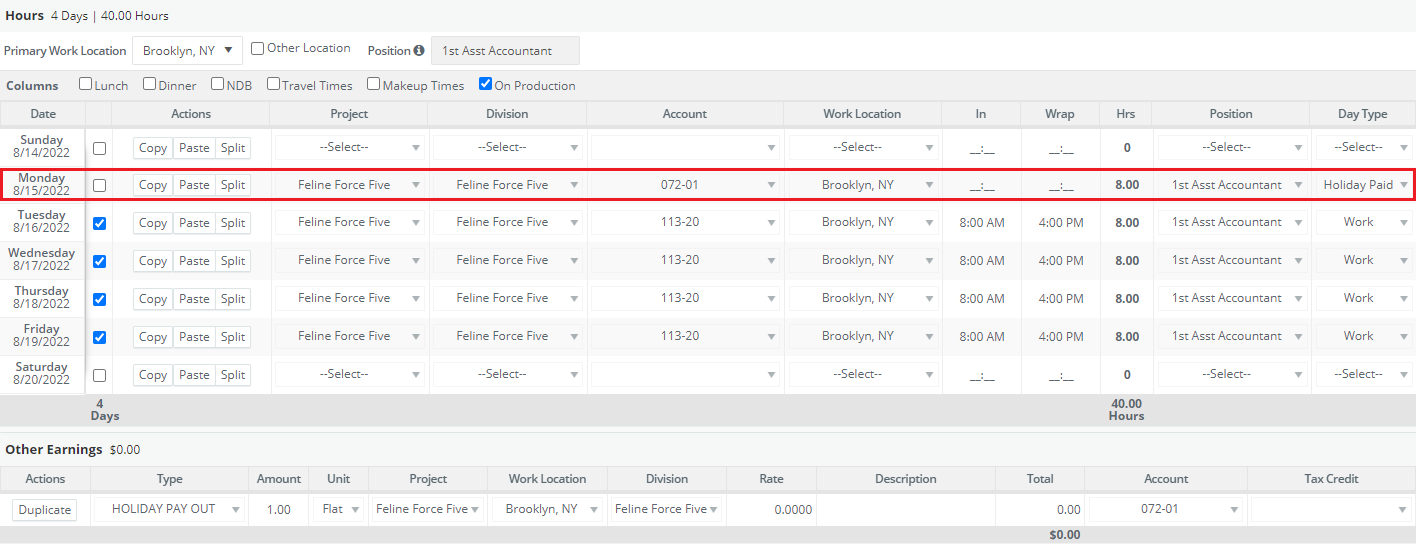

- On digital timecards, when the day type "Holiday Paid" is used or when the Other Earning "Holiday Pay Out" is used, please be sure to update the account code from the labor account code to the accrual account code.

Note: The system will default unworked holiday account coding to the labor account.

- When payroll is processed for unworked holidays or holiday pay outs are made, employees are paid from the balance of accrued holiday pay. When posting payroll, the relevant payroll transactions will show the accrual account is debited (+) for the amount of the unworked holiday, or holiday pay out. This will offset holiday hours accrued from regular work, and clear the balance of the accrual account.