How to: Submit the State W-4

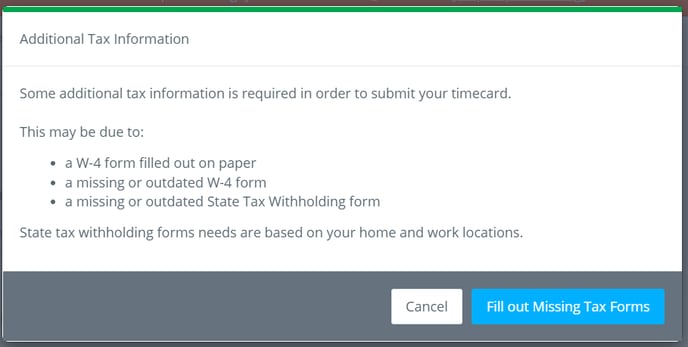

When an employee completes a timecard for a new work location, they will be prompted to complete the state W-4.

When you filled out your initial start work you provided us with your default state withholding preferences. Once you work in a new state we will require you fill out a specific state withholding form.

Step 1: Click FILL OUT MISSING TAX FORMS. This will pop up after clicking submit on the timecard.

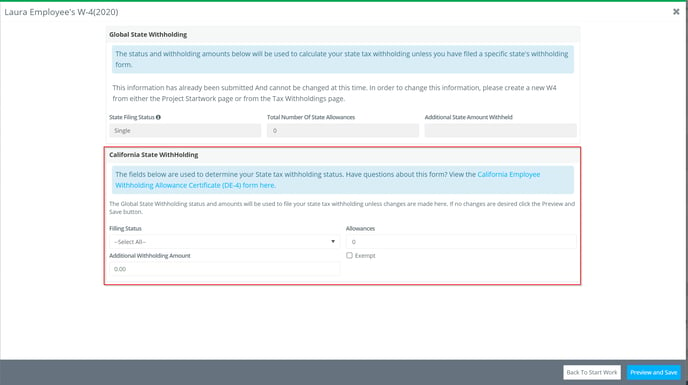

Step 2: If you would like to make changes to your withholdings for the state, complete the fields in the panel. If your Global State Withholdings will apply for this state, only complete the required fields and do not make changes to the withholdings amounts or allowances.

WARNING: Amounts entered in the ADDITIONAL WITHOLDING AMOUNT field will be directly deducted from your paycheck.

Step 3: Click PREVIEW AND SAVE.

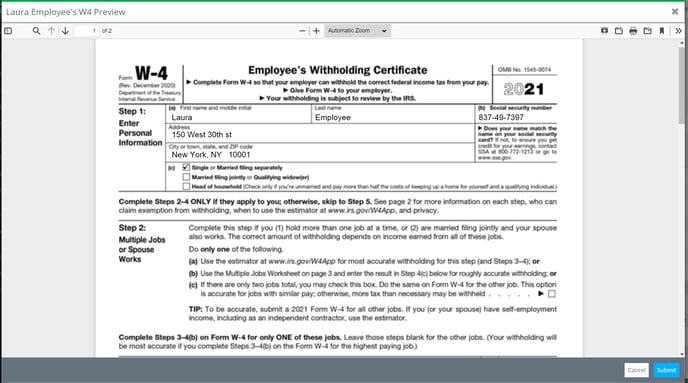

Step 4: Review the preview and click SUBMIT.

To Update your State Withholdings

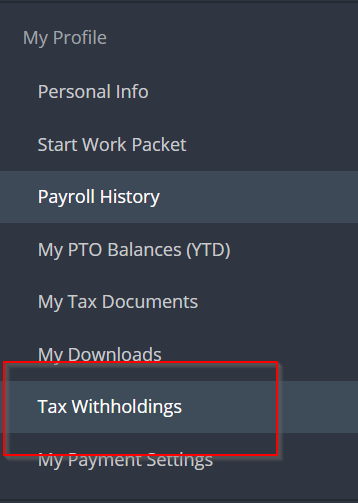

Step 1: Click TAX WITHHOLDINGS on the left navigation.

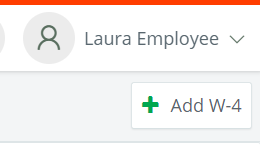

Step 2: Click ADD W-4.

Step 3: Complete Steps 2-4 from above.