How to: Set Up a Loan Out Company

Step 1: Click MY LOAN OUT COMPANY on the left navigation.

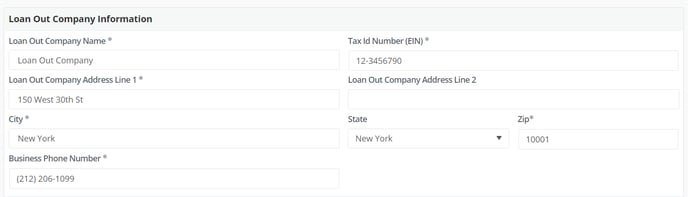

Step 2: Fill out all required fields in the Loan Out Company Information section.

The information remains editable at any time, except for the Company name and Tax ID. These 2 fields are locked as soon as the loan out company is created.

If the Company Name or Tax ID Number (EIN) need to be updated after start work has been submitted, please contact GreenSlate Support.

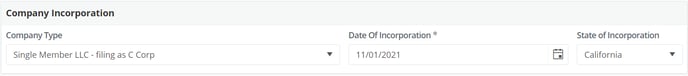

Step 3: Fill out all required fields in the Company Incorporation section.

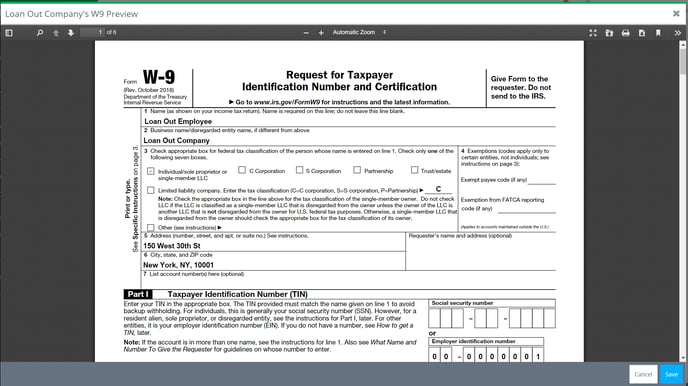

GreenSlate does not accept Partnerships, Trusts, and Estates. Your selection should match section 3 of your W-9 form.

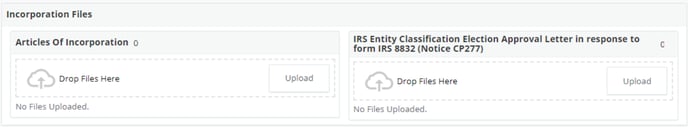

Step 4: Upload Articles of Incorporation and any other required documents. Please note, the file uploader on the right will vary depending on LLC type (C or S).

More information about notice CP261 can be found at:

https://www.irs.gov/individuals/understanding-your-cp261-notice

More information about notice CP277 can be found at:

https://www.irs.gov/individuals/understanding-your-cp277-notice

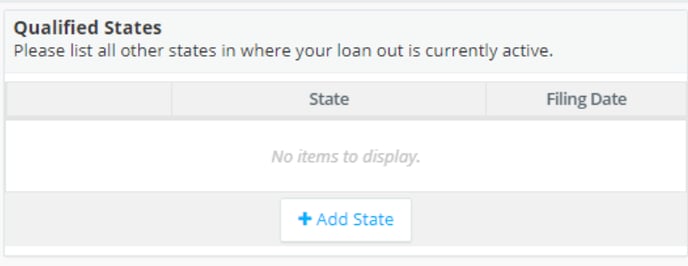

Step 5: Click ADD STATE to add all qualified states.

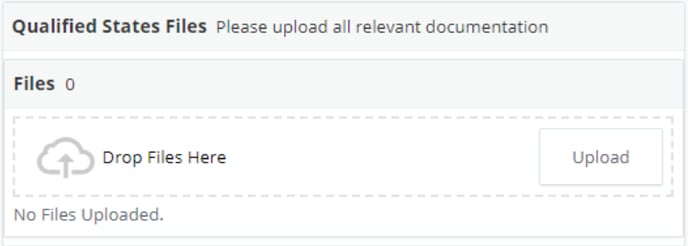

Step 6: Upload any relative documentation such as Certificates of Good Standing.

Step 7: Click SAVE.

Step 8: Review the preview of the W9 and click SAVE.

To submit a loan out start work packet, follow the steps here.